Follow the Money

Huge Sums Are Being Spent on Both Sides of the Ledger

Overview

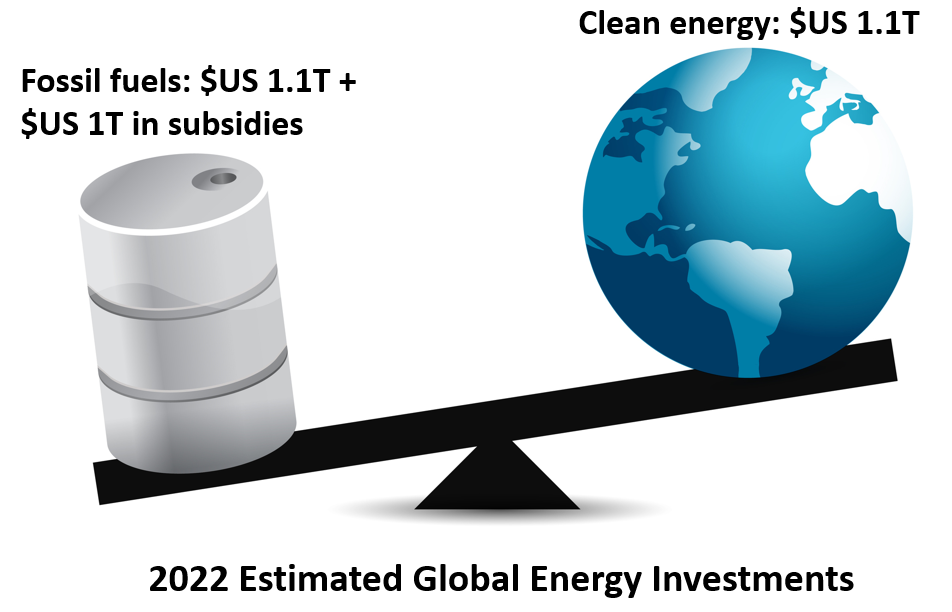

There are huge amounts of capital flowing throughout the world for development of both fossil fuel-based and clean/renewable energy sources. Fossil fuel use is still subsidized by governments in many countries, but the capital flows on each side of the climate change battle line are starting to even out.

Estimates of high-level capital numbers are available from a variety of sources. As would be expected in the complex analysis of global activities, there are significant variances in estimated total amounts. I did my best to summarize what I found to provide a “big picture” perspective in a quick read. All information sources for this post are in the footnotes if you wish to dig further.

Fossil Fuels

The fossil fuel industry is booming, with hundreds of new exploration or production projects expected to be approved over the next few years. Michael Lazarus, Center Director of the Stockholm Environment Institute, foresees the production for these projects coming online near the end of the decade – a time when we should be significantly decreasing our fossil fuel use. [1]

Bloomberg New Energy Finance (BNEF) estimates global fossil fuel investment was $US 1.1T (trillion) in 2022. [2] Of that amount, about $US 430B (billion) was upstream (exploration, drilling, and extraction) oil and gas investment. Upstream investment for 2023 is projected to be around $US 485B according to an update from Oil Price.com. [3] That’s below a peak of $US 700B back in 2013 – 2014.

The International Energy Agency (IEA) estimates there were $US 1T of subsidies for the fossil fuel industry in 2022. Their estimate is based on a process that compares the average end-user prices paid by consumers with reference prices that correspond to the actual cost of supply. [4]

A 2021 working paper from the International Monetary Fund (IMF) includes societal costs in its analysis of how government subsidies result in inefficient pricing of fossil fuels. [5] Societal costs include factors such as environmental damage and adverse health impacts caused by fossil fuel extraction, production and emissions. The paper suggests that in 2020 government subsidies provided an estimated $US 5.9T to the fossil fuel industry globally. If the actual pricing of fossil fuels was not subsidized (i.e., was more efficient), the higher pricing and cost to consumers would be an incentive to decrease fossil fuel use and increase development and use of clean energy sources.

The combination of government subsidies and high demand result in a very healthy fossil fuel industry. On combined revenue of more than $US 1T in 2022, Chevron, ConocoPhillips, Exxon and Shell all reported record profits. [6]

Clean Energy

The IEA predicted global investment in clean energy and energy efficiency would reach $US 2.4T in 2022 [7]. In the full report, they predicted $US 1.4T spending on clean energy investment (which is part of the $US 2.4T figure).

BNEF estimates a global total of $US 1.1T investment in lower-carbon technologies occurred in 2022. They further estimate the world’s power grids got $US 274B of investment. These figures combined are close to the IEA $US 1.4T prediction.

According to Rystad Energy, global investment in the full spectrum of clean energy was lower than the BNEF estimate. Rystad pegs 2022 spending at $US 560B in 2022 and further predicts expenditures to hit $US 620B in 2023.[8]

A country-by-country analysis would make this article much too long, but it makes sense to take a quick look at the biggest emitters of Greenhouse Gases (GHGs): China, the US and India. These countries account for about 43% of global GHGs.

Estimates by BNEF peg China’s 2022 spending on clean energy at about $US 550B. The US spend was about $US 140B. A lack of transparency makes it difficult to estimate India’s spending on its energy transition. The International Institute for Sustainable Development 2022 report on India’s energy policy estimates about $US 77B of public support flows into the energy sector every year, but fossil fuel subsidies are about 9 times that for clean energy. [9] The landscape is changing, however, as the government and numerous Indian companies have recently committed to investing 10s of billions in clean energy projects.

Summary

The IMF working paper provides a very concise summary in its “Conclusion” section:

“But time is of the essence. In the absence of a drastic cut in fossil fuel use over the next decade the planet will become locked into risks of dangerous and irreversible instabilities in the global climate system.”

I guess it is good news that global investment in the transition to clean energy was nearly on par with that invested in fossil fuels in 2022, but more investment in clean energy is needed everywhere. The UN estimates about $US 4T needs to be invested in renewable energy each year until 2030. The global subsidies of fossil fuels tip the scales the wrong way. Subsidies using public funds for fossil fuels need to end, so that fossil fuel prices are more representative of both actual and societal costs.

From an individual perspective, I find these numbers somewhat encouraging. However, the need for more investment in clean energy seems pretty obvious. I plan to keep advocating for more clean energy support with my elected representatives and with energy policy makers. If you can, I hope you’ll do the same.

[1] Stockholm Environment Institute, SEI’s Michael Lazarus to New York Times: US faces ‘contradiction’ between fossil fuel extraction and climate goals, April 6, 2023 https://www.sei.org/about-sei/press-room/michael-lazarus-new-york-times-fossil-fuels/

[2] Global Low-Carbon Energy Technology Investment Surges Past $1 Trillion for the First Time, BloombergNEF, January 26, 2023 https://about.bnef.com/blog/global-low-carbon-energy-technology-investment-surges-past-1-trillion-for-the-first-time/

[3] Upstream Spending To Rise To $485 Billion In 2023, by Alex Kimani, January 21, 2023 https://oilprice.com/Energy/Crude-Oil/Upstream-Spending-To-Rise-To-485-Billion-In-2023.html

[4] Energy subsidies, Tracking the impact of fossil-fuel subsidies, International Energy Agency, https://www.iea.org/topics/energy-subsidies

[5] IMF Working Paper WP/21/236, Still Not Getting Energy Prices Right: A Global and Country Update of Fossil Fuel Subsidies by Ian Parry, Simon Black, and Nate Vernon, September 2021.

[6] CBS News, 4 oil companies had total sales of $1 trillion last year, by Irina Ivanova, February 2, 2023 https://www.cbsnews.com/news/exxon-chevron-shell-conocophillips-record-profits-earnings-oil-companies-most-profitable-year/

[7] Record clean energy spending is set to help global energy investment grow by 8% in 2022, International Energy Agency, Press Release, June 22, 2022 https://www.iea.org/news/record-clean-energy-spending-is-set-to-help-global-energy-investment-grow-by-8-in-2022

[8] Low-carbon investments to rise by $60 billion in 2023 as inflation weakens; hydrogen and CCUS spending to surge, Rystad Energy, Press Release, January 12, 2023 https://www.rystadenergy.com/news/low-carbon-investments-to-rise-by-60-billion-in-2023-as-inflation-weakens-hydroge

[9] International Institute for Sustainable Development, Mapping India’s Energy Policy 2022 https://www.iisd.org/system/files/2022-05/mapping-india-energy-policy-2022.pdf